When it comes to navigating the stock market, one word often stands out as a defining trait for successful investors: discipline. Whether you're a seasoned trader or a beginner in the stock market, maintaining discipline is essential for making informed decisions, managing risks, and achieving long-term success. In this blog, we'll explore why discipline is so important in the stock market and how it can help you become a more confident and consistent investor.

Why Discipline Matters in the Stock Market

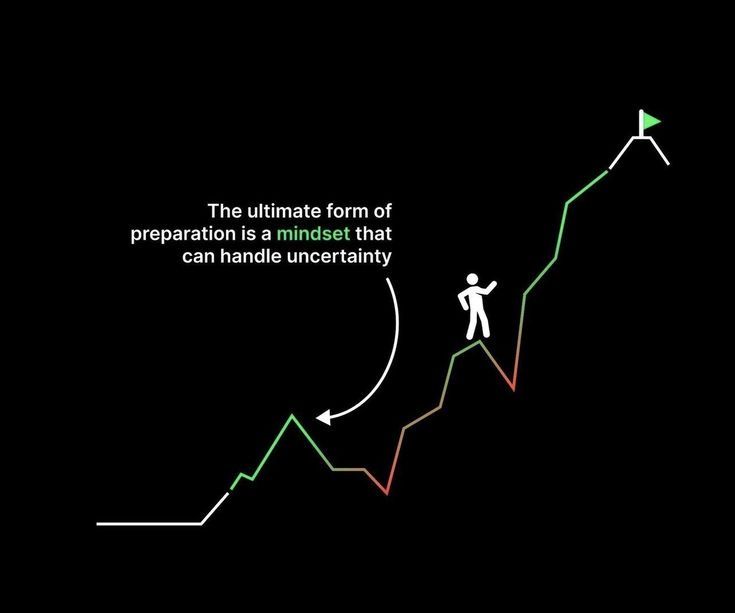

The stock market is known for its volatility and unpredictability. Prices can fluctuate dramatically, driven by factors like economic news, company performance, and global events. These sudden changes can trigger emotional responses like fear or greed, leading many investors to make impulsive decisions that can harm their portfolios.

This is where discipline comes into play. By maintaining a disciplined approach to stock trading, you can avoid emotional reactions and stay focused on your investment strategy. Discipline allows you to stick to your plan, whether the market is soaring or plummeting, helping you avoid costly mistakes such as panic selling during a market dip or buying high out of fear of missing out (FOMO).

Key Benefits of Discipline in Stock Trading

Consistent Decision-Making

One of the most important aspects of discipline is consistency. Successful investors follow a well-thought-out strategy, setting clear goals and criteria for their stock picks. A disciplined approach ensures that you stick to these plans, making decisions based on research and data rather than short-term market noise. Consistency in stock trading helps reduce risk and improves your chances of achieving steady, long-term growth.Better Risk Management

Risk management is critical when investing in the stock market. Discipline helps investors set stop-loss orders, diversify their portfolios, and follow other risk management techniques. Without discipline, you may end up putting too much of your portfolio into high-risk stocks or fail to cut losses in a timely manner. A disciplined strategy ensures that you stay within your risk tolerance and avoid significant financial losses.Emotional Control

Emotions can be one of the biggest obstacles to successful investing. Fear, greed, and impatience can drive investors to make poor decisions, such as selling too early or buying at inflated prices. Discipline helps you maintain emotional control, allowing you to make rational decisions even during periods of market volatility. By keeping emotions in check, you can avoid knee-jerk reactions that might derail your investment strategy.Patience Pays Off

The stock market rewards patience. Stocks, particularly those of strong, well-performing companies, tend to grow in value over time. A disciplined investor understands that long-term gains often outweigh short-term profits. Patience allows you to ride out market fluctuations and stay focused on your long-term goals, leading to greater returns in the future.

Tips for Developing Discipline in Stock Trading

- Create a Trading Plan: Develop a clear strategy that outlines your goals, risk tolerance, and criteria for buying and selling stocks. Stick to this plan, even when market conditions change.

- Use Stop-Loss Orders: Set automatic stop-loss orders to limit potential losses and protect your investments from market downturns.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket by diversifying across different sectors and asset classes. This reduces risk and improves long-term stability.

- Stay Informed: Continuously educate yourself about market trends, stock performance, and the latest financial news. The more informed you are, the better equipped you'll be to stick to your strategy.

- Avoid Overtrading: Trading too frequently based on short-term market movements can lead to losses and increased trading fees. Stay disciplined by avoiding impulsive trades and focusing on long-term growth.

Future Success Through Discipline

Discipline is the cornerstone of a successful investment strategy. It allows investors to weather the ups and downs of the stock market while staying focused on their goals. Whether you're managing a stock portfolio or participating in stock trading for the first time, maintaining discipline ensures that you make consistent, informed decisions that contribute to your long-term financial success.

By integrating discipline into your stock market strategy, you'll be better positioned to handle market volatility, manage risks, and make decisions based on logic rather than emotion. The stock market may be unpredictable, but with discipline, you can maintain control over your investment journey and work toward sustained success.